Recycling Insights is a data science service for the recycling industry.

Shipping is cheaper - will it last?

Will cheaper shipping help to keep prices of recycled materials high?

In the recycling market, shipping is a vital indicator. If shipping prices are high, it means there is more cost pressure on those who are moving material.

Paper grades such as OCC, news & pams and mixed paper are traded globally (although some countries such as China don't allow imports anymore and mixed is banned by some).

Plastic including PET, HDPE and LDPE are also globally traded commodities, although again are banned by countries including China and some South-East Asian nations. Recent Basel Convention rules also means it is harder to export to non-OECD countries from OECD nations.

Scrap metal is also a globally traded commodity.

Recycled materials are therefore influenced by the cost of shipping.

Understanding shipping costs on your margin

Recycling Insights contains shipping indices, allowing you to see trends and giving you the tools to make decisions on your trades.

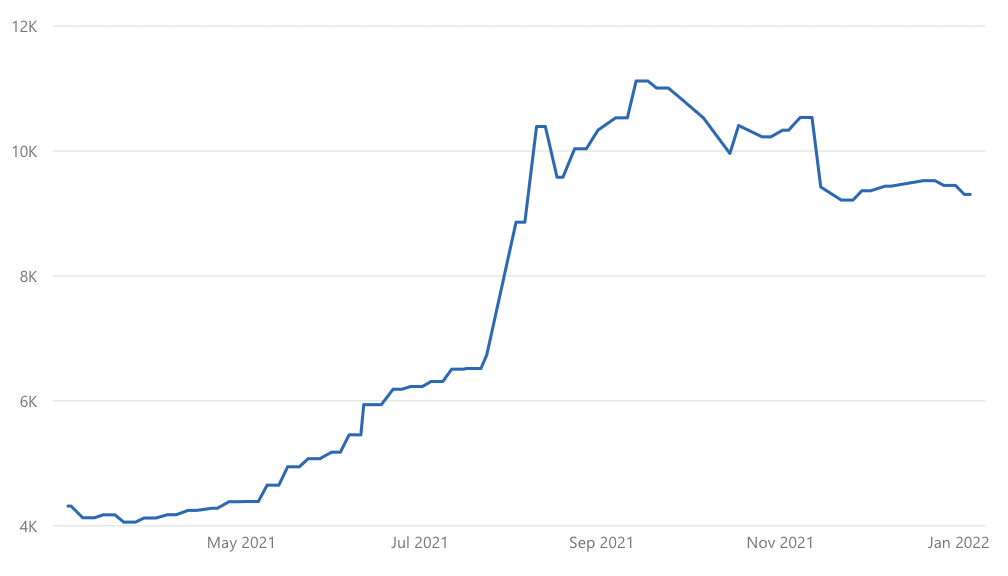

From the middle of 2021, shipping costs started to soar after rising quickly before then. As can be seen in the chart below from Recycling Insights, costs were up considerably from May to July, but after then rose exponentially. Indeed, between the end of July and middle of September, shipping rates had almost doubled. Compared to March, they were almost three times higher.

Are shipping costs on the way down for exporters of recycled materials?

Since the middle of November 2021 to January 2022, shipping prices had fallen and stabilised. For exporters, this means lower costs, although still higher than seen earlier last year.

This is one of the reasons why recyclate prices have been higher recently, and is one of the many factors taken into account in our forecast prices for key materials such as OCC, PET, HDPE, LDPE and Dry Bright Wire.